The Buzz on Advisor Financial Services

Wiki Article

The smart Trick of Financial Advisor Certifications That Nobody is Talking About

Table of ContentsHow Financial Advisor can Save You Time, Stress, and Money.The 15-Second Trick For Financial Advisor Job DescriptionAll about Advisors Financial Asheboro NcThe Single Strategy To Use For Financial Advisor Certifications

There are several kinds of monetary experts out there, each with differing qualifications, specialties, and also levels of accountability. As well as when you get on the quest for a professional fit to your demands, it's not unusual to ask, "Just how do I know which economic advisor is best for me?" The answer begins with a straightforward audit of your needs and a bit of study.That's why it's vital to research study potential consultants and recognize their qualifications before you turn over your cash. Kinds Of Financial Advisors to Take Into Consideration Relying on your financial needs, you may go with a generalised or specialized monetary expert. Understanding your alternatives is the initial step. As you start to study the world of looking for out a monetary expert that fits your demands, you will likely be presented with many titles leaving you questioning if you are speaking to the right person.

It is very important to note that some monetary consultants likewise have broker licenses (meaning they can sell protections), yet they are not solely brokers. On the same note, brokers are not all accredited similarly as well as are not economic advisors. This is simply among the several reasons it is best to start with a qualified monetary organizer who can recommend you on your investments as well as retirement.

Getting The Financial Advisor Meaning To Work

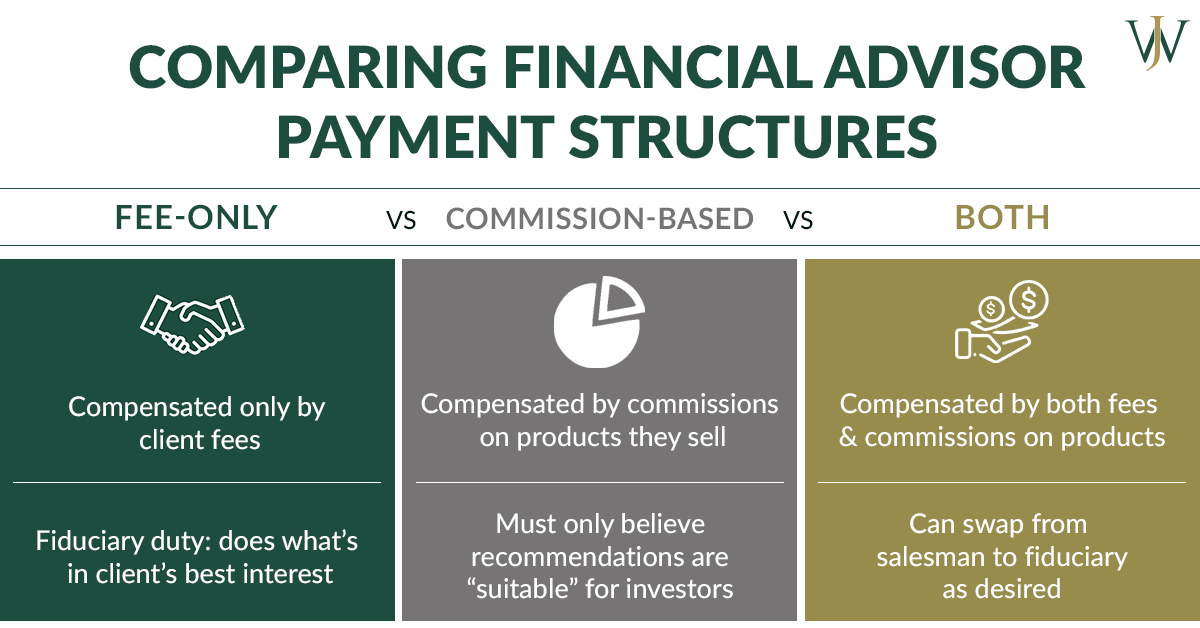

Unlike financial investment experts, brokers are not paid directly by clients, rather, they make compensations for trading stocks and bonds, and for marketing mutual funds as well as other products.

You can normally tell an advisor's specialized from his or her monetary accreditations. An accredited estate organizer (AEP) is an expert that specializes in estate planning. So when you're trying to find an economic advisor, it behaves to have a suggestion what you want assist with. It's likewise worth mentioning economic organizers. financial advisor salary.

Just like "economic expert," "economic organizer" is my latest blog post likewise a broad term. Someone with that title could additionally have other accreditations or specialties. Despite your specific requirements and monetary scenario, one criteria you must strongly take into consideration is whether a possible consultant is a fiduciary. It may stun you to learn that not all monetary advisors are called for to act in their clients' benefits.

Little Known Questions About Financial Advisor Jobs.

To shield on your own from someone that is simply attempting to get even more cash from you, it's a good concept to search for an advisor who is signed up as a fiduciary. A financial expert that is signed up as a fiduciary is called for, by regulation, to act in the very best passions of a article source client.Fiduciaries can just suggest you to make use of such items if they believe it's in fact the most effective economic decision for you to do so. The U.S. Securities and Exchange Commission (SEC) controls fiduciaries. Fiduciaries who stop working to act in a client's benefits might be hit with fines and/or jail time of as much as ten years.

Nevertheless, that isn't due to the fact that anyone can get them. Obtaining either accreditation needs a person to go via a variety of courses as well as tests, in enhancement to making a set amount of hands-on experience. The result of the accreditation process is that CFPs as well as Ch, FCs are skilled in subjects across the area of personal money.

For example, the cost could be 1. try this 5% for AUM between $0 and also $1 million, yet 1% for all possessions over $1 million. Fees normally decrease as AUM boosts. An expert that earns money exclusively from this monitoring cost is a fee-only consultant. The choice is a fee-based advisor. They seem similar, yet there's an essential difference.

A Biased View of Financial Advisor Certifications

/financial-advisor-career-information-526017_v3-01-8def22beb8744989ab21839da3229c01.png)

An advisor's administration cost might or might not cover the expenses linked with trading protections. Some experts also bill an established cost per transaction. Ensure you recognize any type of as well as all of the costs a consultant fees. You don't wish to put all of your cash under their control just to handle hidden shocks later.

This is a solution where the consultant will bundle all account management prices, including trading charges as well as expense proportions, right into one detailed fee. Due to the fact that this fee covers extra, it is generally greater than a fee that just includes monitoring and leaves out things like trading costs. Cover charges are appealing for their simplicity but likewise aren't worth the cost for everybody.

While a standard expert normally bills a cost in between 1% and also 2% of AUM, the charge for a robo-advisor is typically 0. The big compromise with a robo-advisor is that you often do not have the ability to speak with a human advisor.

Report this wiki page